The difference between pre-seed & seed funding for startups

Welcome, fellow startup enthusiasts!

In the fast-paced world of entrepreneurship, securing the right kind of funding is a crucial step towards transforming innovative ideas into successful ventures.

While navigating the funding landscape, you might have come across terms like pre-seed and seed funding.

Today, we embark on an exciting journey to unravel the mysteries surrounding these funding stages and understand their significance for startups.

The Pre-Seed Phase: Planting the Seeds of Entrepreneurship

Picture this: You have a groundbreaking idea, a vision that could potentially disrupt an industry. However, you need resources to nurture your idea and turn it into reality.

That’s where pre-seed funding steps in!

Pre-seed funding is like planting a seed in the fertile ground of entrepreneurship. It involves acquiring initial capital to conduct market research, validate ideas, and build a solid foundation for your startup.

This funding stage typically occurs in the earliest stages of a startup’s life cycle, when founders are still fine-tuning their business models and prototypes.

Unlike seed funding, pre-seed funding is usually sourced from personal savings, friends and family, or angel investors who believe in your potential.

It’s about assembling the resources needed to embark on the entrepreneurial journey and gain the necessary traction before seeking more substantial investment.

The Seed Phase: Nurturing Growth and Blooming Success

Congratulations! Your pre-seed funding has laid the groundwork, and your startup is starting to gain momentum.

Now it’s time to leap from the pre-seed phase to the seed phase.

Seed funding serves as the nourishment for your budding startup, enabling you to scale your operations, refine your product or service, and expand your team.

This funding stage is crucial for startups to fuel their growth and navigate the competitive landscape.

In the seed phase, you can seek investment from angel investors, venture capitalists (VCs), or even strategic partnerships.

Seed funding provides the necessary capital injection to penetrate the market, enhance your product, and attract early customers. It also allows you to attract top talent, build a robust infrastructure, and position your startup for subsequent funding rounds.

Pre-Seed vs. Seed Funding

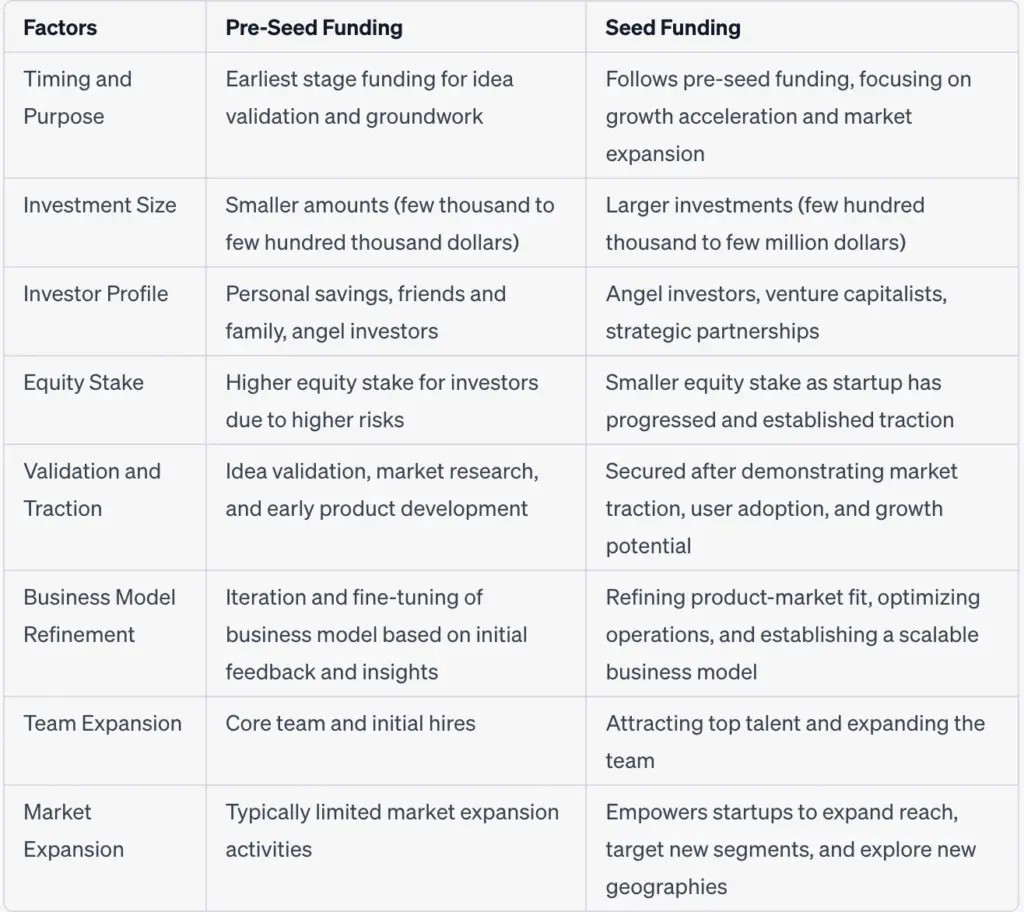

Now that we have a clearer understanding of pre-seed and seed funding, let’s explore the key differences between these two funding stages.

- Timing and Purpose: Pre-seed funding occurs at the nascent stage of a startup, focusing on idea validation and initial groundwork. Seed funding follows the pre-seed phase, targeting growth acceleration, market expansion, and product refinement.

- Investment Size: Pre-seed funding typically involves smaller amounts of capital, ranging from a few thousand to a few hundred thousand dollars. Seed funding, on the other hand, often involves larger investments, ranging from a few hundred thousand to a few million dollars.

- Investor Profile: Pre-seed funding is usually sourced from personal networks, friends and family, or angel investors who believe in the founder’s potential. Seed funding attracts more formal investors, such as angel investors, VCs, or corporate entities.

- Equity Stake: Pre-seed funding often grants investors a higher equity stake due to the higher risks involved at the early stages. In contrast, seed funding investors typically receive a smaller equity stake, as the startup has already progressed and established some traction and value.

- Validation and Traction: Pre-seed funding focuses on idea validation, market research, and early product development. Seed funding is secured after demonstrating market traction, user adoption, and a promising growth trajectory.

- Business Model Refinement: Pre-seed funding allows founders to iterate and fine-tune their business models based on initial feedback and market insights. Seed funding enables startups to refine their product-market fit, optimize operations, and establish a scalable business model.

- Team Expansion: Pre-seed funding often supports the core team and initial hires necessary to kickstart the startup. Seed funding provides the means to attract top talent, expand the team, and build a diverse set of skills and expertise.

- Market Expansion: Seed funding empowers startups to expand their market reach, target new customer segments, and explore new geographies. Pre-seed funding, being more focused on idea validation, typically does not involve significant market expansion activities.

How long should you wait between pre-seed and seed funding?

The duration between pre-seed and seed funding can vary depending on various factors, including the progress and needs of the startup.

Although there isn’t a typical time frame, you ideally want to raise enough capital to give you a runway between 6 – 18 months.

Typically, startups may seek seed funding after they have achieved certain milestones and demonstrated sufficient market traction. This could include reaching a significant user base, generating revenue, or showcasing promising growth potential.

The time it takes to achieve these milestones can vary widely based on the nature of the business, industry dynamics, and market conditions.

In some cases, startups may secure seed funding shortly after pre-seed funding, especially if they quickly achieve notable progress. However, in other instances, startups may take several months or even years to transition from pre-seed to seed funding, as they work on refining their product, building a customer base, and proving their business model’s viability.

Startups must focus on achieving key milestones and demonstrating their potential to investors before seeking seed funding.

Is it possible to skip a pre-seed round and go directly to seed?

The decision to skip the pre-seed round depends on various factors, including the startup’s progress, market conditions, funding needs, and the availability of potential investors.

In some cases, startups may have a compelling business idea or a strong founding team that attracts seed investors directly.

This can occur when the founders have a proven track record, deep industry expertise, or a unique value proposition that resonates with investors.

If the startup has already made significant progress, demonstrated market traction, and achieved key milestones without pre-seed funding, they may choose to bypass that stage and directly pursue seed funding.

However, it’s important to note that the pre-seed funding stage can provide valuable resources, validation, and support for early-stage startups. It allows founders to refine their business models, conduct market research, and develop initial prototypes. Pre-seed funding can also help build credibility and establish a solid foundation before seeking larger investments.

Skipping the pre-seed round means potentially missing out on the benefits that come with it, such as early-stage feedback, mentorship, and access to a network of angel investors. Startups should carefully assess their specific circumstances and weigh the advantages and disadvantages of bypassing the pre-seed stage before making a decision.

The Funding Continuum: Preparing for the Future

Understanding the difference between pre-seed and seed funding is essential for startups as they progress along their funding journey.

While pre-seed funding lays the foundation and enables initial validation, seed funding propels startups toward growth, scalability, and market penetration.

It’s important to note that pre-seed and seed funding are just two stages in a broader funding continuum.

As startups evolve, they may proceed to raise Series A, B, C, and subsequent rounds of funding to fuel further expansion, research and development, and market dominance.

Each funding round comes with its own unique requirements, expectations, and investor landscape.

To successfully navigate the funding landscape, startups should:

- Craft a Compelling Story: Develop a clear and compelling narrative around your startup’s mission, vision, and potential impact to attract investors’ interest and support.

- Build a Solid Network: Cultivate relationships with angel investors, mentors, industry experts, and potential partners who can provide guidance, resources, and investment opportunities.

- Demonstrate Traction: Show evidence of market traction, user engagement, and revenue generation to instill confidence in potential investors and differentiate yourself from competitors.

- Strategize Funding Rounds: Plan your funding rounds strategically, considering the amount of capital required at each stage, the dilution of equity, and the milestones you aim to achieve with each round.

- Be Investor-Ready: Prepare comprehensive financial projections, business plans, and pitch decks that highlight the growth potential, scalability, and value proposition of your startup.

Related Posts

How is Pre-seed Different from Angel Funding?

Here is an overview of some key differences between pre-seed funding and angel funding for startups:

Stage of Business

- Pre-seed funding is meant for brand new startups working on initial proof-of-concepts and prototyping

- Angel investors typically get involved after the idea validation and MVP stages once traction is demonstrated

Investor Experience

- Most pre-seed investors are founders themselves or serial entrepreneurs knowledgeable about the earliest stages

- Angel investors may not have direct startup experience but invest based on belief in the founder’s capabilities

Investment Size and Structure

- Pre-seed funding ranges from thousands to low hundreds of thousands with flexible or no equity involved

- Angel rounds are usually $100K to $2M+ with investors receiving equity or convertible notes

Investor Involvement

- Pre-seed investors provide advice and connections but typically do not take active oversight roles

- Angels often take advisory board seats and mentor positions providing hands-on support

Fundraising Process

- Pre-seed is typically raised informally from founders’ networks or accelerators

- Raising from organized angel groups involves formal pitches and due diligence

Here is a table summarizing the key differences between pre-seed funding and angel funding:

| Criteria | Pre-Seed Funding | Angel Funding |

|---|---|---|

| Stage of Business | Early stage on ideas and prototypes | Post-MVP with some traction and proof points |

| Typical Investors | Founders, friends and family, incubators | Active angel investors individually or in groups |

| Typical Investment Size | $10K – $250K | $100K – $2M |

| Investment Instrument | Common stock, safe note, other flexible structures | Convertible notes or priced equity |

| Investor Involvement | Limited involvement | Hands-on support and advisory roles |

| Fundraising Process | Informal, personal networks | Formal pitch processes and diligence |

| Company Maturity | Pre-revenue, no full team | May have some revenue/users, core team in place |

| Milestone Expectations | Validating idea, early product testing | Proving repeatable traction and metrics |

| Exit Time Horizon | Longer term, higher risk | Variable but faster than VC fund cycles |

In summary, pre-seed funding supports raw startup ideas on a smaller scale while angels invest in more structured startups demonstrating initial traction and viability.

Conclusion

In the thrilling journey of entrepreneurship, securing the right funding at the right time can make all the difference.

Pre-seed and seed funding are pivotal stages that provide startups with the necessary resources, validation, and momentum to thrive in the competitive business landscape.

Remember, each stage serves a distinct purpose and requires careful planning, execution, and investor engagement.

As you embark on your own startup adventure, equip yourself with a deep understanding of pre-seed and seed funding dynamics.

Embrace the opportunities they present, leverage your networks, and craft a compelling story that captivates investors.

With perseverance, resilience, and a well-executed funding strategy, you can turn your entrepreneurial dreams into reality.

So, dear entrepreneurs, dare to dream, embrace the challenges, and seek the funding that will propel your startup to new heights.