What are the different roles & job titles in venture capital?

In an earlier post, we covered how VCs evaluate early-stage startups. In this post, we’ll look at the different roles in a VC firm.

A venture capital firm is a company that provides money and advice to startup companies in the hopes of profiting from their success. The key role of a VC firm is to invest early into promising startups and give good returns to their investors who are called LPs or Limited Partners. VCs raise money from LPs to invest in great startups.

The people who work at a venture capital firm can be broken down into three different roles: investors, partners, and employees.

Venture capital firms usually have a team of people working in each of these roles. The size of the team depends on the size of the firm. The team works together to find and invest in the best startups and then help these startups grow and eventually exit at a premium valuation.

Investors are the people who provide money to the venture capital firm. Partners are the people who make the decisions about which companies to invest in. Employees are the people who do the research on potential investments and help with due diligence. Employees help with the day-to-day operations of the firm and can be further categorized into analysts, associates, principals, etc.

The different roles in a VC firm

The most important people at a venture capital firm are the investors. They are the ones who provide the money that a venture capital firm uses to invest in startups. The investors also have a lot of say in how the firm is run.

Partners are the people who make the decisions about which companies to invest in. They work closely with the investors to make sure that the firm is investing in the right companies. Associates are the people who do the research on potential investments and help with due diligence. They also help with the day-to-day operations of the firm.

Venture capital firms usually have a team of people working in each of these roles. The size of the team depends on the size of the firm. The team works together to find and invest in the best startups.

There are different roles in a venture capital firm, each with its own focus and responsibilities.

The most common roles are:

1) Managing Partner

2) General Partner (GP)

3) Principal

4) Venture Partner (VP)

5) Associate

6) Analyst

7) Investor Relations

8) Entrepreneur-in-residence

9) Marketing & social media

10) Interns

11) VC Scout

12) Limited Partner

13) Back Office Roles

The Managing Partner

The Managing Partner is responsible for the firm’s day-to-day operations and sets the investment strategy. The managing partner is also the key person responsible for fundraising.

Managing partners are positioned at the top of the firm’s hierarchy and typically have ownership stake in the managing company. As a result, they have control over the venture firm.

The main point of contact with the limited partners and responsible for most strategic and executive decisions, they vote on investment opportunities as well as take board seats in portfolio companies. Their primary role is to map out the fund’s long-term strategy.

The Managing Partner in a large fund is usually someone who has been with the company for a long time or was one of the founding members. These partners typically take more backseat roles and may have other businesses they are focusing on as well.

In newer and smaller funds, the Managing Partners are usually the partners who created the venture firm, closed the first fund, and have a much more all-inclusive set of duties. They’re also generally in charge of how the fund operates.

Partners/General Partners

In hierarchical funds, terms such as junior and senior partners are used to distinguish levels of experience within the partnership. This affects how much of a percentage each partner gets from the profitability of the fund. If the distribution isn’t equal, then generally speaking, junior members will get less of a share.

A firm can have a flattened partnership where all partners have the same status and carry.

The General Partner or GP the day-to-day strategic tasks within a firm or for a particular fund. They often spend time managing the portfolio for either the entire organization or just the individual fund they’ve been assigned to. Additionally, they offer years of experience and knowledge in various fields.

The most important thing to remember is that the partners are the ones who can sponsor a deal. In other words, they can suggest that the firm invest in a company and recommend that the firm take a vote (usually at a ‘partner meeting’) on whether or not to go through with the investment.

They can both source deals and also evaluate deals brought in by others in the firm. They have the power to write checks and execute deals.

Principals

The principals of an investment team are its senior members. They not only help the firm identify and connect with the most promising entrepreneurs in a given industry but also maintain relationships with those companies after investment.

A Principal will typically have at least 6-8 years of experience in the investment space.

Though they are not part of the investment committee, at times they may get a stake in the profits–called carried interest–from deals that they bring to the firm.

The partners at the firm work closely with their training counterparts on deals and other aspects of running the business. Principals often have different titles such as Investment Managers, VPs, etc.

Principals have the ability and influence to set up meetings and introductions that can be extremely helpful for your business. In addition, Principals are often highly networked individuals who can offer assistance in a variety of other ways.

Venture Partners

Larger venture capital firms have venture partners (also known as operating partners). They’re seasoned investors or entrepreneurs who aren’t full partners of the company.

Venture partners are hired by a partnership to search for new investment opportunities and handle portfolio businesses. They can also serve as advisors to portfolio firms and sit on their boards of directors.

A venture partner can be either full-time or part-time.

Venture partners have a good understanding of your company’s market and know how to put a deal together. They do not, however, possess the power to independently approve a transaction, which means they must rely on managing partners for support.

Although a venture partner isn’t permanently affiliated with the organization, they may stick with it for years. Ex-partners who still wish to do business from time to time are examples of venture partners.

Associates

Members of the investment team who are slightly less experienced are called associates. They’re typically in their role for two to three years before possibly being promoted to Principal or leaving for another opportunity.

Associates working at typical investment funds are in charge of researching industries, market trends, and companies.

Although Associates don’t lead investments, they’re often visible at events and workshops. Their role is outward-facing more often than not and includes meeting with many different types of companies. They act as a first filter, bringing the most relevant cases to the attention of those higher up in investment teams.

Since they play such an important role in managing information, it’s crucial that you try to meet and get along with them well. If you do, they’ll be more likely to introduce you to other senior members of their team.

Analysts

Analysts are the most junior members of an investment team and are entry-level positions in the fund. They typically have two or three years of experience, often in banking, consulting, or at a startup.

The analyst role is a pre-MBA role and many analysts work in this role for around 2 years after which they go to pursue an MBA.

They typically report to an Associate who helps with inbound deal flow, early due diligence, and research into possible investments.

Investor relations manager

The role of an investor relations manager in a VC firm is to manage and monitor the communication between the firm and its limited partners.

An investor relations manager is responsible for creating and maintaining a positive relationship with the investors. They will often organize events, such as conferences and webinars, to keep investors updated on the latest news.

The investor relations manager will also work with the marketing team to produce materials, such as pitch decks and impact reports.

Entrepreneur in residence

The role of an entrepreneur in residence in a VC firm varies. The primary role of an EIR is to work with portfolio companies and help them grow.

An entrepreneur in residence is typically a successful entrepreneur who has experience in growing a startup. They will offer their expertise and guidance to portfolio companies, and help them with things such as fundraising and hiring.

Often, an EIR can use the firm’s resources to build its own startup and eventually get funded by the firm.

Marketing & Social Media

The role of a marketing & social media executive in a VC firm is to raise awareness of the brand and generate leads.

A marketing & social media executive is responsible for creating and executing marketing campaigns. They will often use digital channels, such as email and social media, to reach a wide audience.

The marketing & social media executive will also work with the investor relations team to produce materials, such as pitch decks and impact reports.

Interns

The role of interns in a VC firm is to support the team with various tasks.

Interns will often be responsible for conducting research, preparing materials, and attending events. They will also get the opportunity to shadow the different team members and learn about the various roles in venture capital.

Internships could be paid or unpaid, but they can lead to full-time roles at the firm.

VC scout

The role of a VC scout is to identify and assess deal flow for the firm.

A VC scout is responsible for finding new investment opportunities and conducting initial research on them. They will often attend startup events and meetups to network with founders.

The VC scout will then present their findings to the investment team, who will decide whether to pursue the investment.

The scout is an unpaid role and is more of an intern role where you get the opportunity to work with a VC firm to get some exposure to the industry and could act as a gateway to venture capital.

Back Office Roles

While the investment team at a VC firm takes the spotlight, the back office functions are crucial for supporting the firm’s operations:

Finance & Accounting – Tracks capital flows between limited partners and portfolio investments. Manages LP financial reporting and capital calls. Oversees fund and management of company finances.

HR & Recruiting – Sources strong talent for open roles across the investment team and back office. Ensures employee satisfaction and retention.

Administration – Ensures office operations and infrastructure run smoothly so investment staff can focus on deal execution. Handles purchasing, event planning, office management, and maintenance.

Legal -Drafts investment term sheets and closes financing rounds. Reviews portfolio company governance issues. Ensures regulatory compliance for fundraising and foreign investments.

Technology/IT – Implements and manages key systems for deal management, pipeline tracking, and research databases to enable seamless information flows and collaboration for the investment team. Ensures robust cybersecurity protections.

Marketing – Drives brand awareness, content creation, and showcasing fund results to support continued fundraising efforts and deal sourcing.

The back office team handles mission-critical capabilities that keep the VC firm running effectively and efficiently behind the scenes.

They ensure the firm has strong financial controls, talent programs, LP communications, and systems/processes so the partners can focus on investing and adding value to portfolio companies. The back office is an engine that powers overall firm success.

| Title | Role | Full-time or Part-time | Compensation Type | Salary Range |

|---|---|---|---|---|

| Analyst | Conduct research, financial modeling, support due diligence | Full time | Base salary | $80,000 – $120,000 |

| Associate | More hands-on deal sourcing and due diligence | Full time | Base salary + bonus | $120,000 – $170,000 |

| Principal | Lead deal execution and portfolio company support | Full time | Base salary + carry | $180,000 – $250,000 |

| Venture Partner | Source new deals, board roles, advise companies | Part-time | Carry + fees | $250,000 – $500,000+ |

| Partner | Lead deal sourcing through exit, sit on boards, raise capital | Full time | Carry majority + base salary | $500,000+ |

| Managing Partner | Set firm strategy and operations, manage GP group | Full time | Ownership stake | Multi-million dollar take-home |

| Entrepreneur in Residence | Advise portfolio companies | Part-time | Fee-based | $150,000+ |

| Interns | Conduct research, pipeline development | Part-time, temporary | Stipend or unpaid | $5,000 per summer |

| VC Scout | Identify new investments | Part-time | Fee if the lead converts | Minimal base |

Venture Capital Salaries

Salaries can vary significantly within venture capital firms depending on the size of funds under management, stage and sector of investments, and geographic location. However, average salary ranges are as follows across firms in major VC hubs in the US:

Analysts: $80,000 – $120,000 The base salary for junior level investment analysts tends to be on the lower end to start, but signing bonuses upon joining a firm can add another $20-30k.

Associates: $120,000 – $170,000 The associate position sees a meaningful jump in base compensation potential after 2-3 years as an analyst. Bonus can also reach 20-50% of the base.

Principals: $180,000 – $250,000 Principals take a large step up to have higher potential earnings, earn carried interest, and manage their investment portfolios. Larger funds and bi-coastal firms pay more.

Venture Partners: $250,000 – $500,000+ Venture partners have the versatility to earn a combination of salary, carry, advisory shares, and fees across fund and portfolio company boards. Total income can exceed $500-750K at top-tier firms.

Partners: $500,000+ For general and managing partners, the majority of earnings come from carry or their ownership stake in the overall venture capital firm, which can drive total take-home pay to several million dollars in good funds and markets.

The career trajectory in venture capital allows professionals to reach higher compensation brackets as they progress into advanced roles with more fund economics participation. Upside through bonuses and carry enhances earning potential.

Can you Get Into Venture Capital? – Self-evaluation Quiz

Here is a 10-question self-evaluation quiz with scoring to assess venture capital role fit and skills:

- The idea of conducting research and financial modeling to evaluate nascent startups appeals to me: a) Strongly agree b) Somewhat agree

c) Not particularly

d) Strongly disagree - I enjoy working in fast-paced environments with ambiguity and change: a) Very much b) To some degree c) Neutral d) Prefer more stability

- I proactively build connections and network with startups and executives in my sector: a) Frequently b) Occasionally c) Rarely d) Networking feels inauthentic

- My ability to understand new technologies and quickly analyze product-market fit is:

a) Very strong

b) Moderately strong c) Somewhat limited currently d) Very limited - My communication style resonates well with entrepreneurial personalities: a) True b) Somewhat True c) Not Really d) False

- I thrive when advising founders and enjoy contributing strategic ideas:

a) Absolutely! b) Somewhat c) Neutral d) Prefer hands-off relationships - My experience working directly for a venture capital firm or startup includes: a) 3+ years

b) 1-2 years c) Internships only d) No direct experience - My core motivation for pursuing venture capital is: a) Build transformational companies b) Achieve financial independence

c) Gain status and influence

d) Cushy career with high income - My personal and professional network within the startup ecosystem is: a) Broad and deep b) Moderate c) A work in progress

d) Very limited currently - An area of self-development for me around venture capital is:

a) Advising/mentoring startup founders b) Analyzing advanced technologies c) Evaluating business models/unit economics d) Networking with angel investors

Scoring:

4 points – Each “a” answer

3 points – Each “b” answer

2 points – Each “c” answer

1 point – Each “d” answer

Total Score:

35-40 points = Excellent fit level

25-34 points = Moderate fit currently

Under 25 points = May require significant development

What’s your score and where do you plan to focus efforts on improving your venture capital readiness?

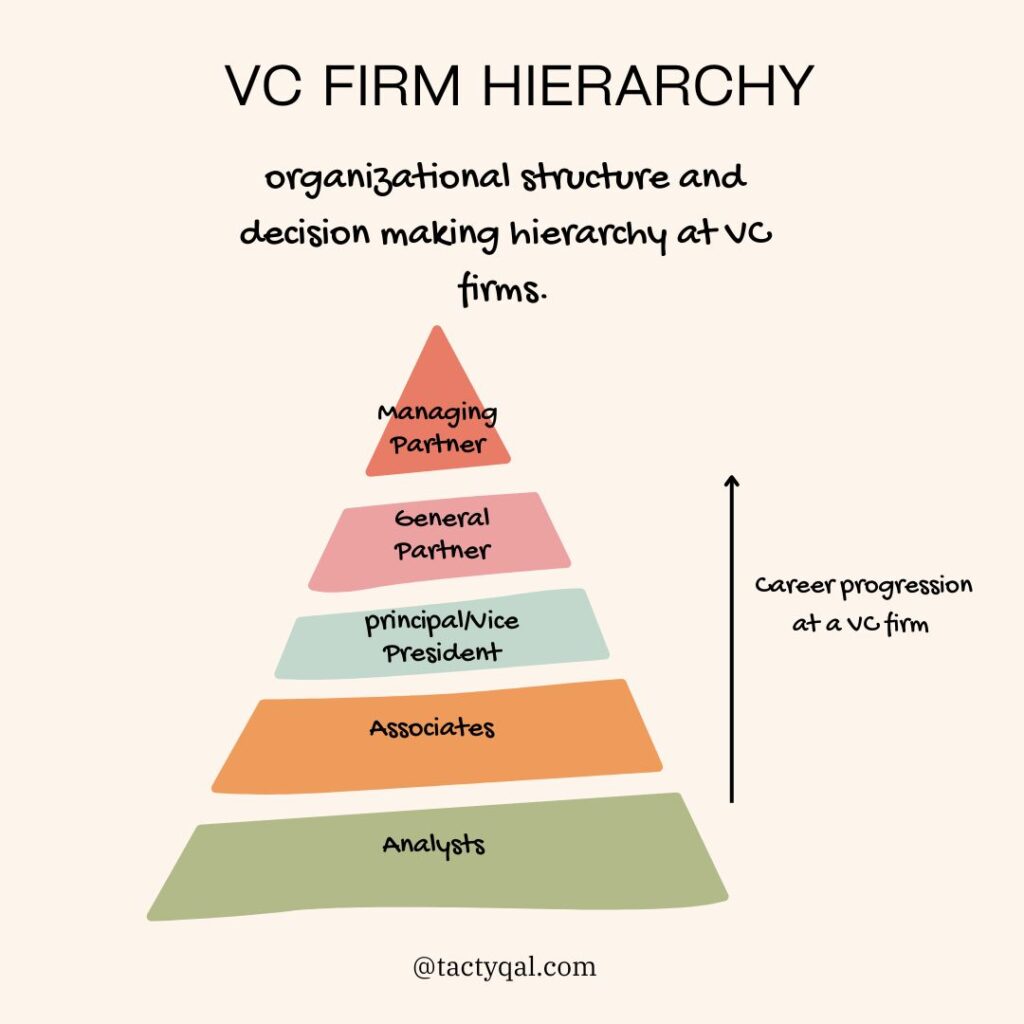

Venture Capital Firm Hierarchy

Venture capital firms have a structured hierarchy that helps them function effectively and make investment decisions. Even though each firm has its own organizational makeup, the typical hierarchy at VC firms is as follows:

- General Partners: The general partners sit at the top of the hierarchy. They are the primary decision-makers who approve investments and chart long-term strategy. They also manage limited partner relations and fundraising activities. General partners get a share of the fund’s profits.

- Managing Partners: In most VC firms, there is a single managing partner or sometimes two who manage day-to-day operations and portfolio management. They work very closely with general partners but have more responsibilities tied to daily execution.

- Venture Partners: Venture partners work on sourcing and evaluating new deals. They may have a narrow investment scope and sector-specific expertise. Venture partners often have operating experience as a founder or executive. They take board seats and advise portfolio companies.

- Principals: Principals conduct due diligence on potential deals across different sectors and stages. They are very active in investment decision-making and portfolio support roles. Some may lead specific functional initiatives at the firm around technology or operations.

- Associates: Associates have 3-5 years of experience, often with prior roles in investment banking or consulting. They conduct market research and financial modeling, supporting the investment process. Associates explore new deals and potential leads.

- Analysts: Analysts are typically early in their finance careers with 1-2 years experience. They assist senior team members, conducting company and industry research. Analysts perform initial screening and analysis of potential deals.

The hierarchy represents experience and decision-making authority held by different professionals working together to identify and nurture a strong portfolio of investments. Roles are fluid, but this offers a representative venture capital firm structure.

Career Progression in Venture Capital

Professionals working in venture capital have ample opportunities for career advancement in the space. The typical career track is as follows:

- Analyst: Most start on the investment team as research analysts with 0-2 years of work experience. Analysts conduct market research, financial analysis, and assist with due diligence. This role offers a chance to explore venture capital as a career.

- Associate: After 2-4 years analysts are usually promoted to associates. Associates take on a more hands-on role supporting deal sourcing and due diligence. They have more contact with startup founders and entrepreneurs in the ecosystem.

- Principal: The next step up is principal or senior associate. Principals start leading areas of the research process and investment efforts. They may take board observer seats and manage relationships with certain portfolio companies.

- Partner: After 6-10 years experience, principals can get promoted to partner or venture partner. Full partners have investment committee voting authority and lead deals from sourcing to exit. They raise capital as the face of the firm to limited partners. Partners enjoy a share of the investment profits through carried interest.

- Managing Partner/General Partner: Partners who excel can rise to managing partner or GP, directing investment decisions and broader strategic initiatives for the firm and managing partner group.

The Role of Limited Partners (LPs)

The Limited Partners

The Limited Partners (LPs) are the investors that provide the capital for the VC fund. These are the “silent” partners that put up the money but don’t take an active role in managing the fund.

LPs comprise large institutions and high net-worth individuals looking to invest money into early-stage companies for potentially high returns. Typical LPs include university endowments, foundations, pension funds, family offices, and fund of funds.

The primary role of the LPs is to commit capital that the General Partners then invest into startups and ventures. They do not participate in the VC firm’s day-to-day operations or investment decisions.

LPs conduct extensive due diligence on the fund before investing, assessing the experience, capabilities, and track record of the VCs that will be managing the fund. They want to gain confidence that the General Partners can effectively deploy the committed capital for strong returns.

Once invested, LPs will receive periodic updates, financial reports, and capital calls from the VC firm as portfolio investments are made and eventually sold for profits. LPs ultimately aim to see high multiple returns on their invested capital over the life of the long-term partnerships, typically 10 years or longer.

The LPs thus act as the financial fuel to power VC investments in innovative companies, providing the capital in exchange for a share of eventual upside returns. Their backing allows VCs to function and take risks on new ventures.

If you enjoyed reading this article, check out some of our other posts on venture capital.

- How to raise a venture capital fund?

- Why do startups need funding?

- A guide to deal flow in venture capital

- What is dry powder in venture capital & startup investments?

- What is IRR and why IRR is the most important metric in venture capital

- Angel investors vs VCs

- How VCs are controlling the narrative of what constitutes as a good business?

- Startup term sheets: Everything you wanted to know

- How to get into venture capital?